As the craze of earnings season draws to a close, here’s a look back at some of the most exciting (and some less so) results from Q3. Today, we are looking at footwear stocks, starting with Wolverine Worldwide (NYSE:WWW).

Before the advent of the internet, styles changed, but consumers mainly bought shoes by visiting local brick-and-mortar shoe, department, and specialty stores. Today, not only do styles change more frequently as fads travel through social media and the internet but consumers are also shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some footwear companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 7 footwear stocks we track reported a satisfactory Q3. As a group, revenues beat analysts’ consensus estimates by 1.5% while next quarter’s revenue guidance was 7.9% above.

While some footwear stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 1.3% since the latest earnings results.

Wolverine Worldwide (NYSE:WWW)

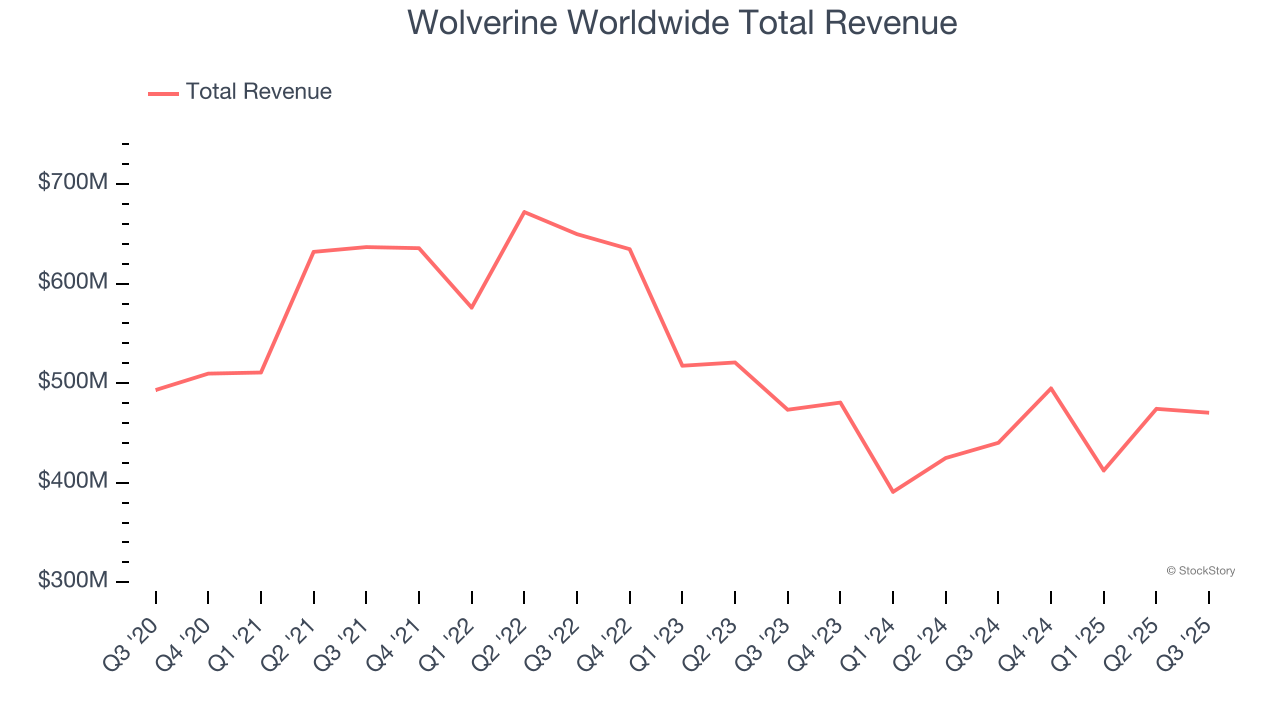

Founded in 1883, Wolverine Worldwide (NYSE:WWW) is a global footwear company with a diverse portfolio of brands including Merrell, Hush Puppies, and Saucony.

Wolverine Worldwide reported revenues of $470.3 million, up 6.9% year on year. This print exceeded analysts’ expectations by 1.3%. Despite the top-line beat, it was still a mixed quarter for the company with a decent beat of analysts’ EBITDA estimates but full-year revenue guidance meeting analysts’ expectations.

"We delivered a solid quarter with Merrell, Saucony, and Sweaty Betty all exceeding expectations. Our disciplined execution, coupled with another record gross margin quarter, delivered better-than-anticipated earnings per share," said Chris Hufnagel, President and Chief Executive Officer of Wolverine Worldwide.

Wolverine Worldwide pulled off the highest full-year guidance raise of the whole group. Still, the market seems discontent with the results. The stock is down 2.6% since reporting and currently trades at $18.50.

Is now the time to buy Wolverine Worldwide? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Nike (NYSE:NKE)

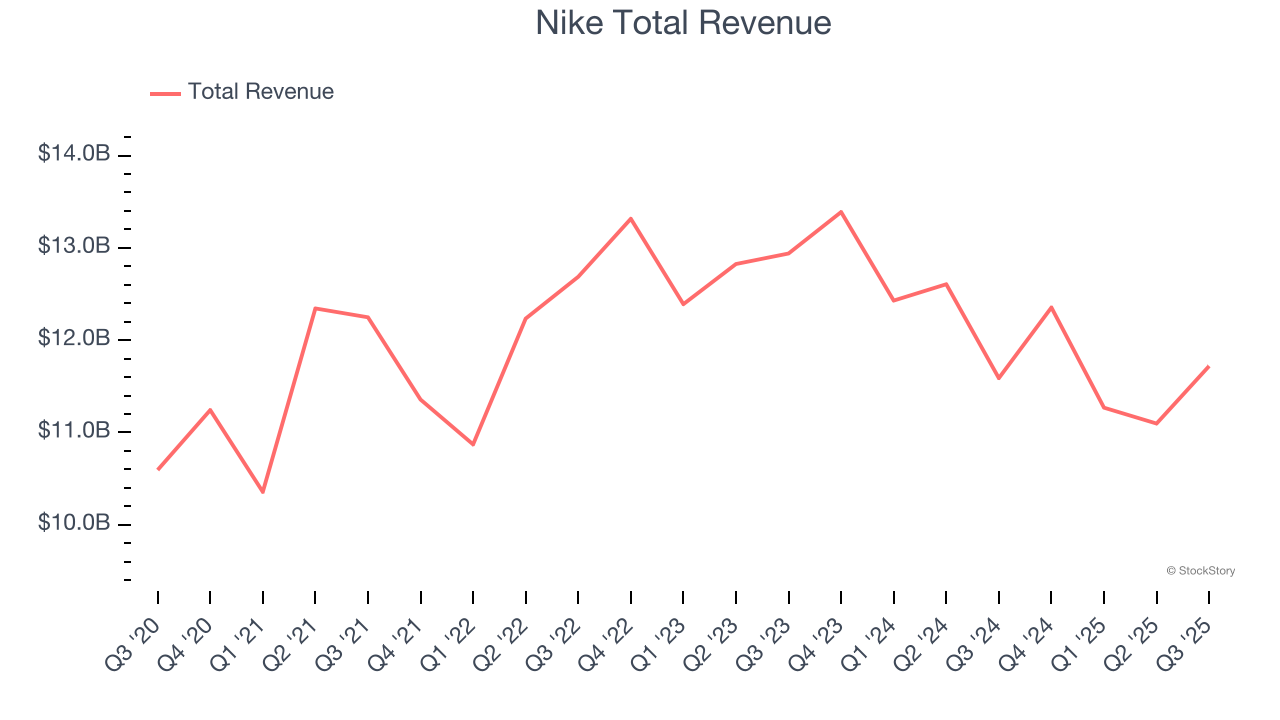

Originally selling Japanese Onitsuka Tiger sneakers as Blue Ribbon Sports, Nike (NYSE:NKE) is a global titan in athletic footwear, apparel, equipment, and accessories.

Nike reported revenues of $11.72 billion, up 1.1% year on year, outperforming analysts’ expectations by 6.5%. The business had an incredible quarter with a solid beat of analysts’ constant currency revenue estimates and a beat of analysts’ EPS estimates.

Nike scored the biggest analyst estimates beat among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 2.6% since reporting. It currently trades at $67.94.

Is now the time to buy Nike? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Caleres (NYSE:CAL)

The owner of Dr. Scholl's, Caleres (NYSE:CAL) is a footwear company offering a range of styles.

Caleres reported revenues of $790.1 million, up 6.6% year on year, exceeding analysts’ expectations by 2.8%. Still, it was a disappointing quarter as it posted full-year EPS guidance missing analysts’ expectations significantly and a significant miss of analysts’ adjusted operating income estimates.

The stock is flat since the results and currently trades at $13.53.

Read our full analysis of Caleres’s results here.

Crocs (NASDAQ:CROX)

Founded in 2002, Crocs (NASDAQ:CROX) sells casual footwear and is known for its iconic clog shoe.

Crocs reported revenues of $996.3 million, down 6.2% year on year. This result beat analysts’ expectations by 3.3%. Overall, it was an exceptional quarter as it also recorded a solid beat of analysts’ constant currency revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Crocs had the slowest revenue growth among its peers. The stock is up 3.8% since reporting and currently trades at $87.94.

Read our full, actionable report on Crocs here, it’s free for active Edge members.

Steven Madden (NASDAQ:SHOO)

As seen in the infamous Wolf of Wall Street movie, Steven Madden (NASDAQ:SHOO) is a fashion brand famous for its trendy and innovative footwear, appealing to a young and style-conscious audience.

Steven Madden reported revenues of $667.9 million, up 6.9% year on year. This print lagged analysts' expectations by 4%. Zooming out, it was actually a strong quarter as it logged EPS guidance for next quarter exceeding analysts’ expectations and revenue guidance for next quarter exceeding analysts’ expectations.

Steven Madden had the weakest performance against analyst estimates among its peers. The stock is up 37% since reporting and currently trades at $44.99.

Read our full, actionable report on Steven Madden here, it’s free for active Edge members.

Market Update

In response to the Fed’s rate hikes in 2022 and 2023, inflation has been gradually trending down from its post-pandemic peak, trending closer to the Fed’s 2% target. Despite higher borrowing costs, the economy has avoided flashing recessionary signals. This is the much-desired soft landing that many investors hoped for. The recent rate cuts (0.5% in September and 0.25% in November 2024) have bolstered the stock market, making 2024 a strong year for equities. Donald Trump’s presidential win in November sparked additional market gains, sending indices to record highs in the days following his victory. However, debates continue over possible tariffs and corporate tax adjustments, raising questions about economic stability in 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.