Specialty food company Lancaster Colony (NASDAQ:LANC) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 2.9% year on year to $457.8 million. Its GAAP profit of $0.95 per share was 39.8% below analysts’ consensus estimates.

Is now the time to buy Lancaster Colony? Find out by accessing our full research report, it’s free.

Lancaster Colony (LANC) Q1 CY2025 Highlights:

- Revenue: $457.8 million vs analyst estimates of $483.3 million (2.9% year-on-year decline, 5.3% miss)

- EPS (GAAP): $0.95 vs analyst expectations of $1.58 (39.8% miss)

- Operating Margin: 10.9%, up from 7.5% in the same quarter last year

- Sales Volumes were flat year on year (1.5% in the same quarter last year)

- Market Capitalization: $5.32 billion

CEO David A. Ciesinski commented, “We were pleased to report third quarter records for gross profit and operating income. The 2.9% decline in consolidated net sales includes the unfavorable impacts of the perimeter-of-the-store bakery product lines we exited in March 2024 and the shift of some Retail segment sales into our fiscal fourth quarter due to the later Easter holiday. In addition, we experienced a more challenging consumer environment in our fiscal third quarter as evidenced by reduced traffic in the foodservice channel and some softening demand in the retail channel. Despite the headwinds, our Retail segment’s licensing program remained a source for growth in the quarter as we began shipping Chick-fil-A® sauce into the club channel; our Texas Roadhouse™ dinner rolls continued to perform very well; and the Subway® sauces we introduced last March delivered incremental sales. Net sales for our category-leading New York Bakery™ frozen garlic bread products also improved. In our Foodservice segment, net sales decreased 3.2%, reflective of the industry-wide decline in store traffic and the impact of menu changes as some customers shifted to value offerings. Higher demand from some of our core national chain restaurant accounts helped to support Foodservice segment sales.”

Company Overview

Known for its frozen garlic bread and Parkerhouse rolls, Lancaster Colony (NASDAQ:LANC) sells bread, dressing, and dips to the retail and food service channels.

Sales Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but many enduring ones grow for years.

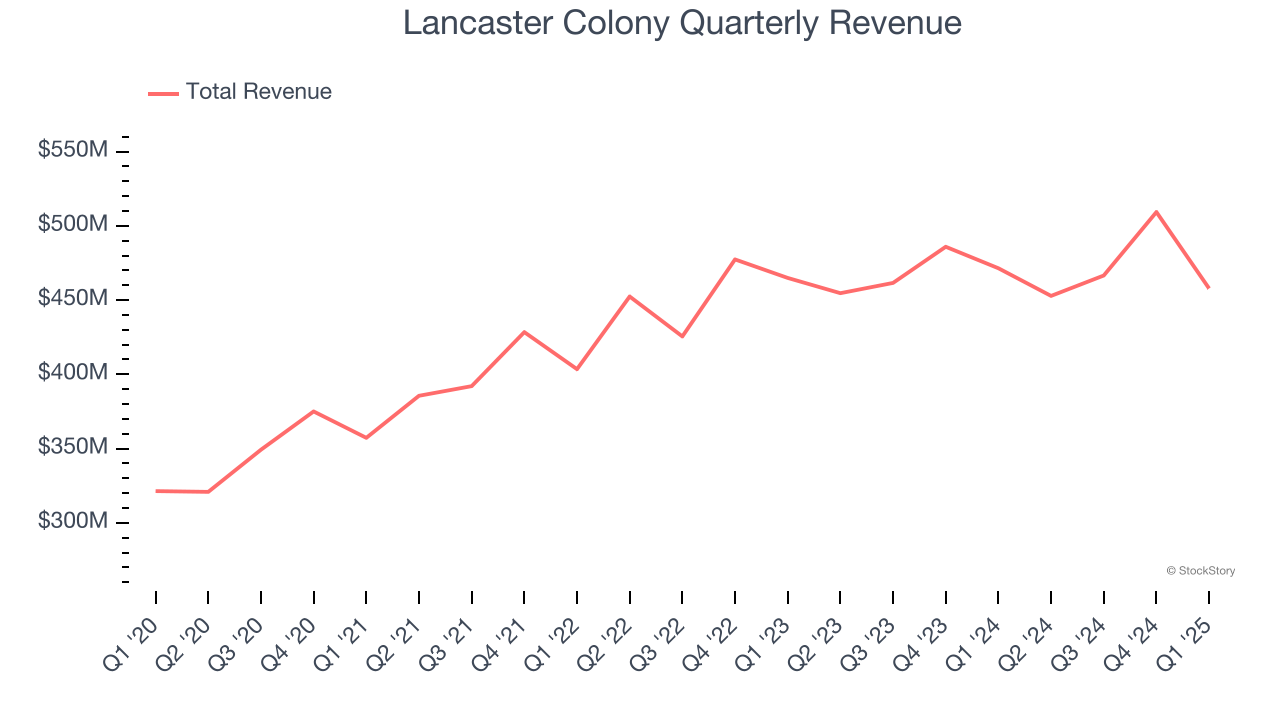

With $1.89 billion in revenue over the past 12 months, Lancaster Colony is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers.

As you can see below, Lancaster Colony’s 5.4% annualized revenue growth over the last three years was tepid, but to its credit, consumers bought more of its products.

This quarter, Lancaster Colony missed Wall Street’s estimates and reported a rather uninspiring 2.9% year-on-year revenue decline, generating $457.8 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 4.7% over the next 12 months, similar to its three-year rate. This projection is underwhelming and implies its newer products will not accelerate its top-line performance yet.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

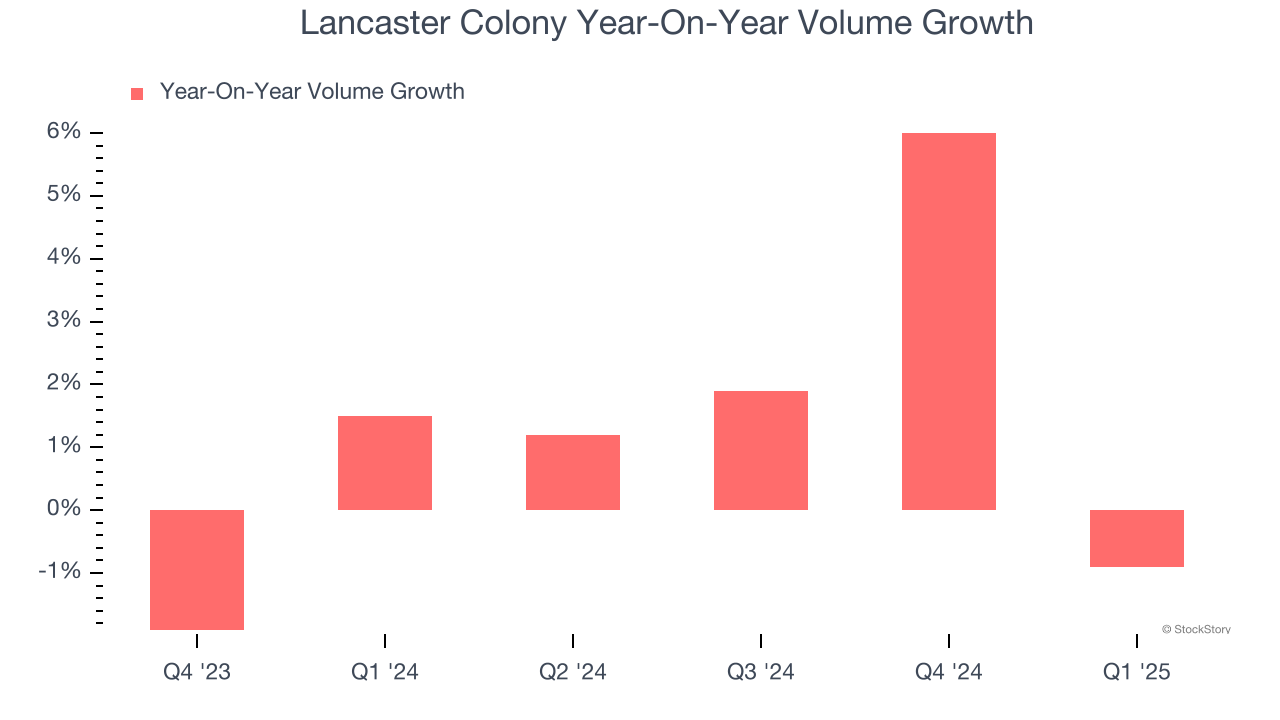

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Lancaster Colony’s average quarterly volume growth was a healthy 1.3% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Lancaster Colony’s Q1 2025, year on year sales volumes were flat. This result was a meaningful deceleration from its historical levels. We’ll be watching closely to see if Lancaster Colony can reaccelerate demand for its products.

Key Takeaways from Lancaster Colony’s Q1 Results

We struggled to find many positives in these results. Its revenue missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.3% to $182.72 immediately following the results.

Lancaster Colony didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? We think that the latest quarter is only one piece of the longer-term business quality puzzle. Quality, when combined with valuation, can help determine if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.