SPX Technologies currently trades at $154.42 and has been a dream stock for shareholders. It’s returned 283% since June 2020, more than tripling the S&P 500’s 90.4% gain. The company has also beaten the index over the past six months as its stock price is up 6% thanks to its solid quarterly results.

Is now still a good time to buy SPXC? Or are investors being too optimistic? Find out in our full research report, it’s free.

Why Does SPX Technologies Spark Debate?

SPX Technologies (NYSE:SPXC) is an industrial conglomerate catering to the energy, manufacturing, automotive, and aerospace sectors.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

Long-term growth is the most important, but within industrials, a stretched historical view may miss new industry trends or demand cycles. SPX Technologies’s annualized revenue growth of 13.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

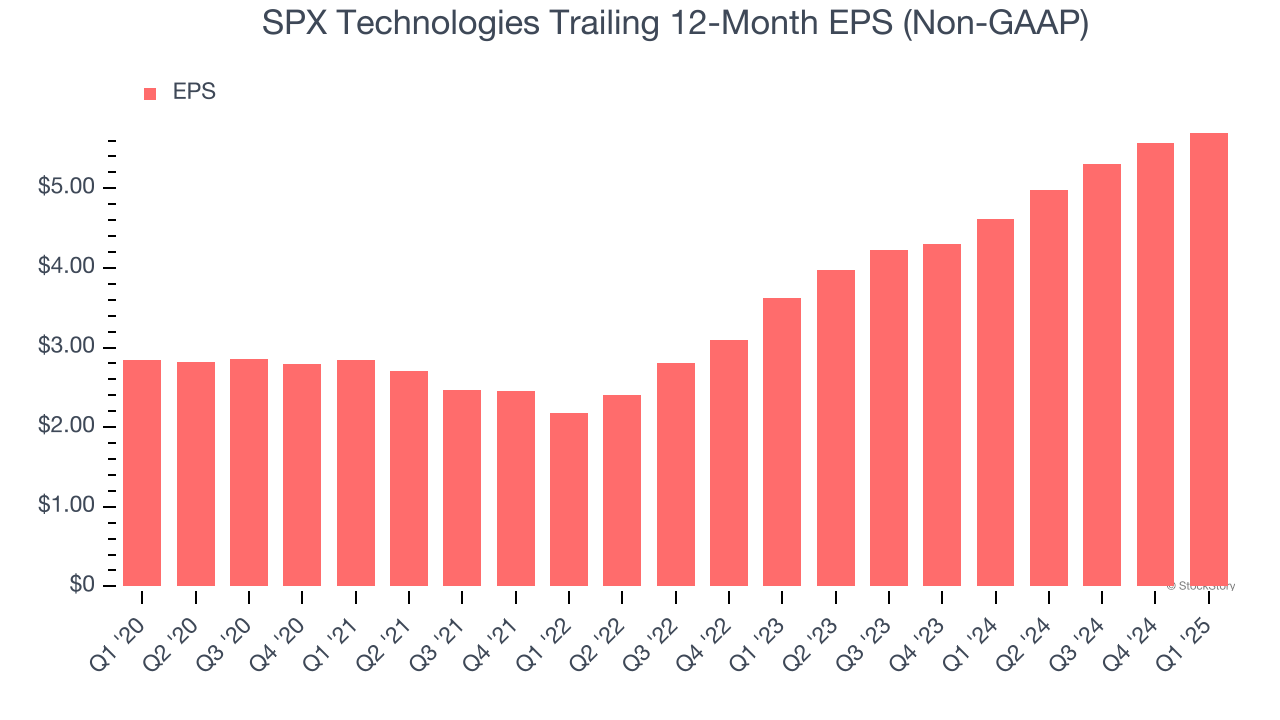

2. Outstanding Long-Term EPS Growth

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

SPX Technologies’s EPS grew at a spectacular 14.9% compounded annual growth rate over the last five years, higher than its 5.3% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

One Reason to be Careful:

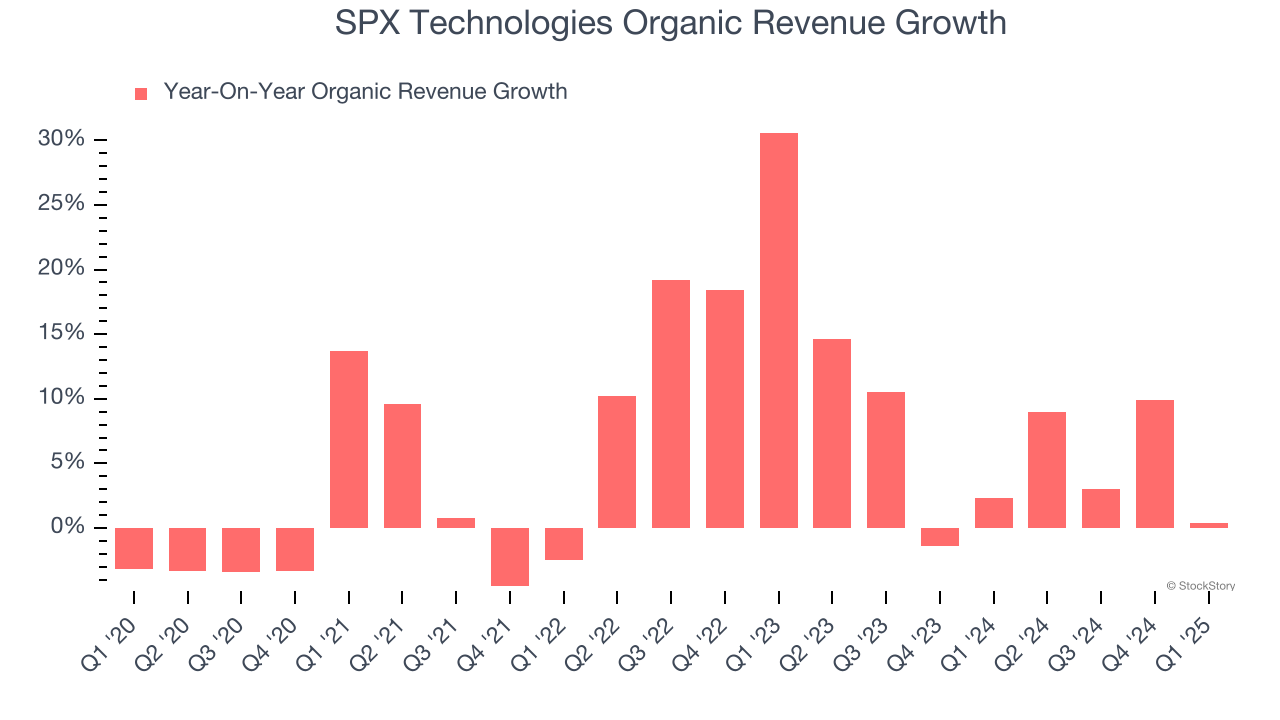

Slow Organic Growth Suggests Waning Demand In Core Business

We can better understand Gas and Liquid Handling companies by analyzing their organic revenue. This metric gives visibility into SPX Technologies’s core business because it excludes one-time events such as mergers, acquisitions, and divestitures along with foreign currency fluctuations - non-fundamental factors that can manipulate the income statement.

Over the last two years, SPX Technologies’s organic revenue averaged 6.1% year-on-year growth. This performance slightly lagged the sector and suggests it may need to improve its products, pricing, or go-to-market strategy, which can add an extra layer of complexity to its operations.

Final Judgment

SPX Technologies’s merits more than compensate for its flaws, and with its shares topping the market in recent months, the stock trades at 24.3× forward P/E (or $154.42 per share). Is now the time to initiate a position? See for yourself in our comprehensive research report, it’s free.

Stocks We Like Even More Than SPX Technologies

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.