Aris Water has had an impressive run over the past six months. While the S&P 500 has been flat, the stock has returned 5.3% and now trades at $25.92. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is now still a good time to buy ARIS? Or is this a case of a company fueled by heightened investor enthusiasm? Find out in our full research report, it’s free.

Why Are We Positive On Aris Water?

Primarily serving the oil and gas industry, Aris Water (NYSE:ARIS) is a provider of water handling and recycling solutions.

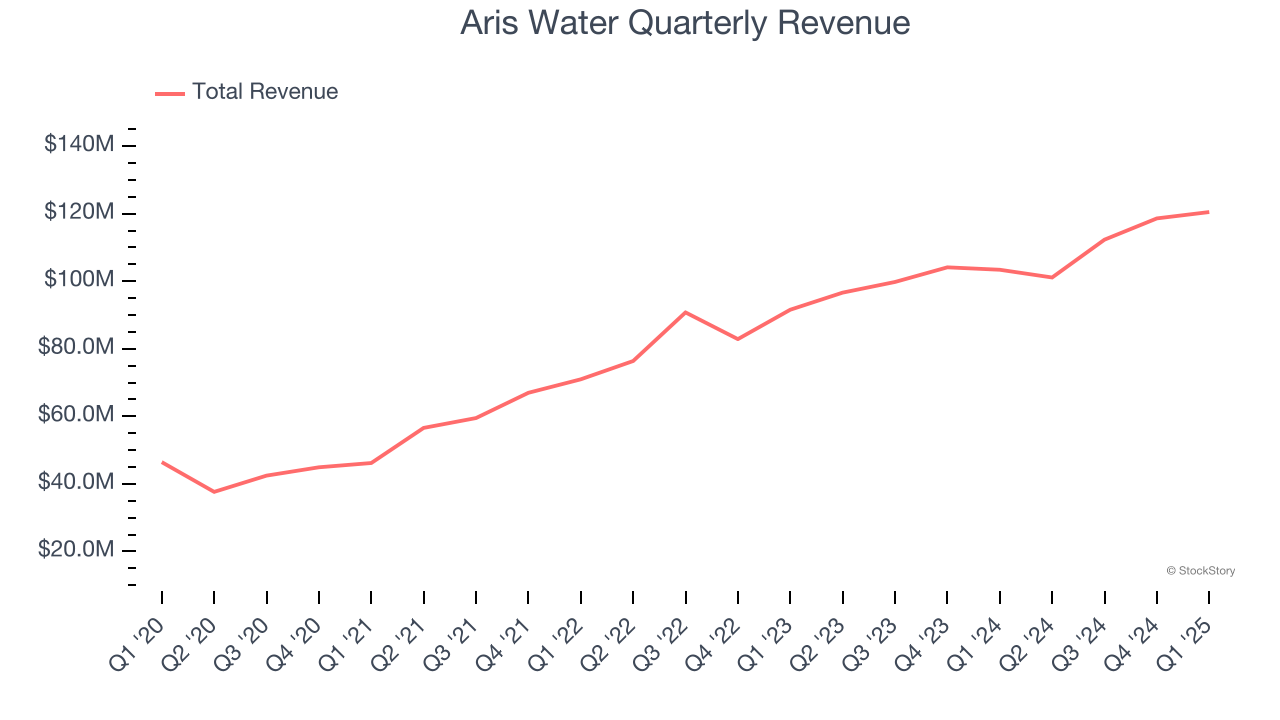

1. Skyrocketing Revenue Shows Strong Momentum

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Luckily, Aris Water’s sales grew at an incredible 27.5% compounded annual growth rate over the last four years. Its growth beat the average industrials company and shows its offerings resonate with customers.

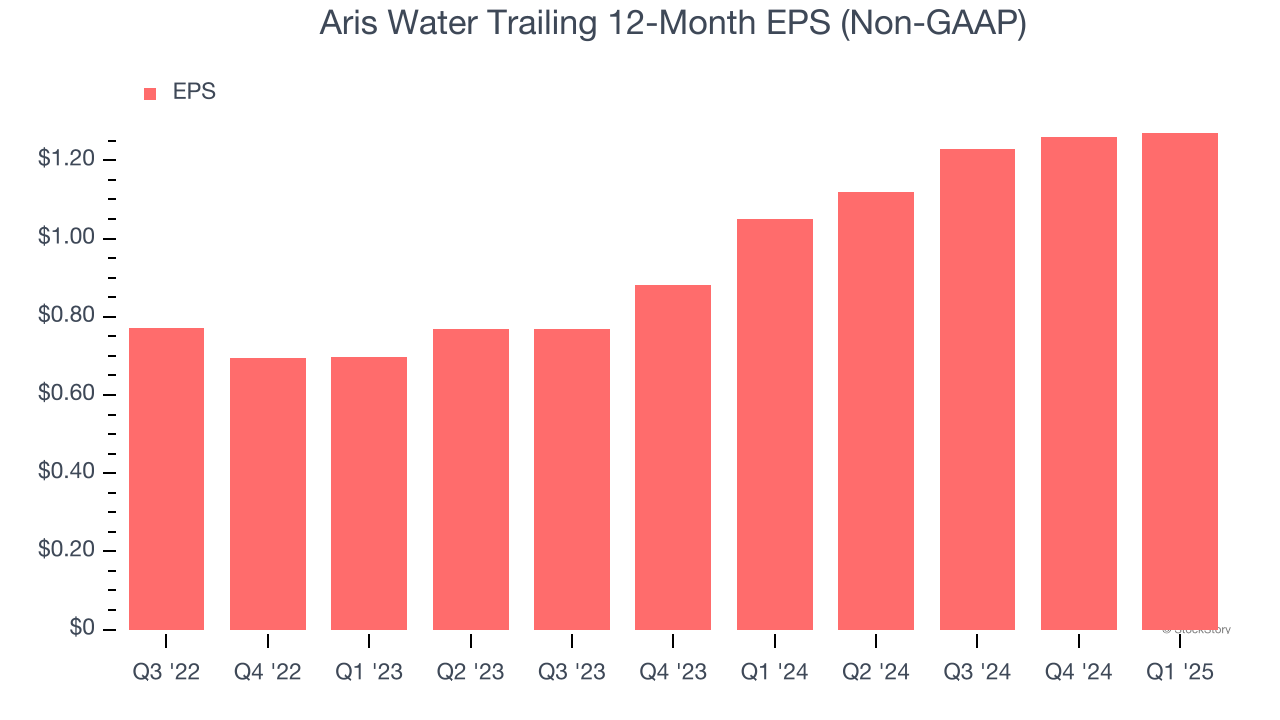

2. Outstanding Long-Term EPS Growth

We track the change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Aris Water’s full-year EPS grew at an astounding 17.6% compounded annual growth rate over the last three years, better than the broader industrials sector.

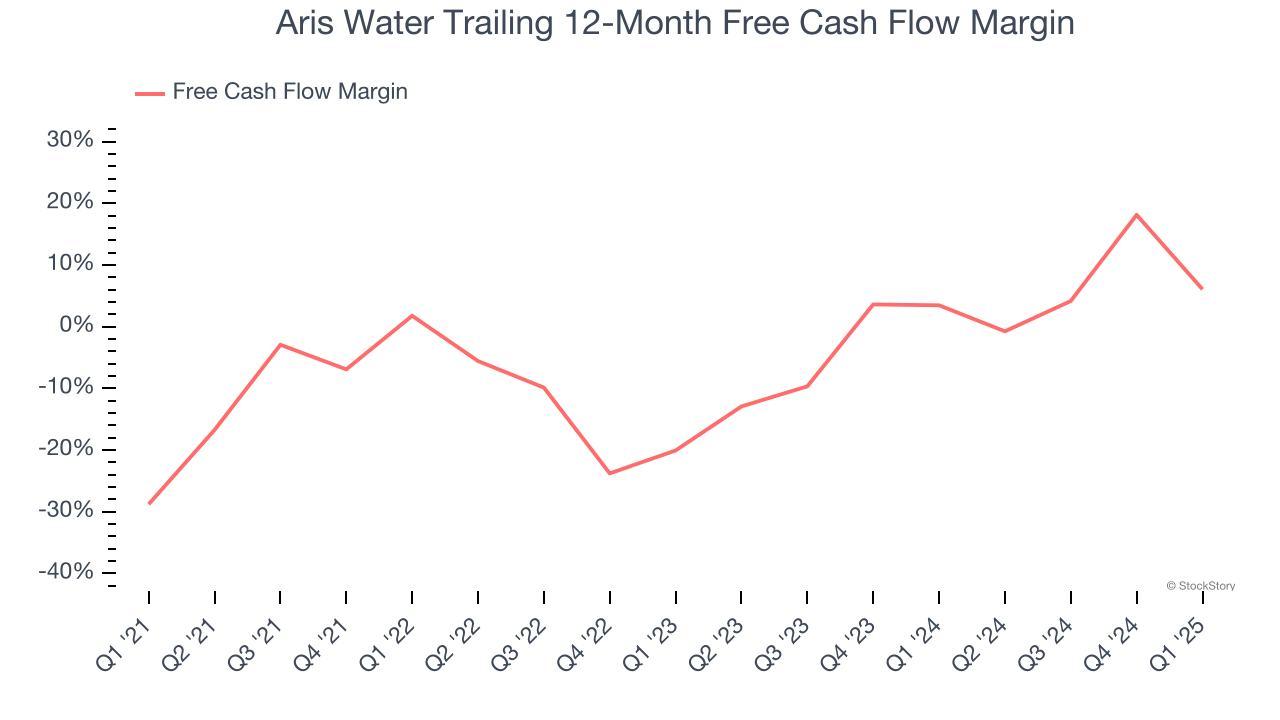

3. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Aris Water’s margin expanded by 34.8 percentage points over the last five years. Aris Water’s free cash flow margin for the trailing 12 months was 6.1%.

Final Judgment

These are just a few reasons why we think Aris Water is one of the best industrials companies out there, and with its shares beating the market recently, the stock trades at 17.2× forward P/E (or $25.92 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.