Since December 2024, Home Bancshares has been in a holding pattern, posting a small loss of 2.3% while floating around $27.63.

Is now the time to buy Home Bancshares, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Is Home Bancshares Not Exciting?

We're swiping left on Home Bancshares for now. Here are three reasons why you should be careful with HOMB and a stock we'd rather own.

1. Revenue Growth Flatlining

We at StockStory place the most emphasis on long-term growth, but within financials, a stretched historical view may miss recent interest rate changes, market returns, and industry trends. Home Bancshares’s recent performance shows its demand has slowed significantly as its revenue was flat over the last two years.

2. Projected Net Interest Income Growth Is Slim

Forecasted net interest income by Wall Street analysts signals a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Home Bancshares’s net interest income to rise by 1.4%, close to its flat result for the past two years.

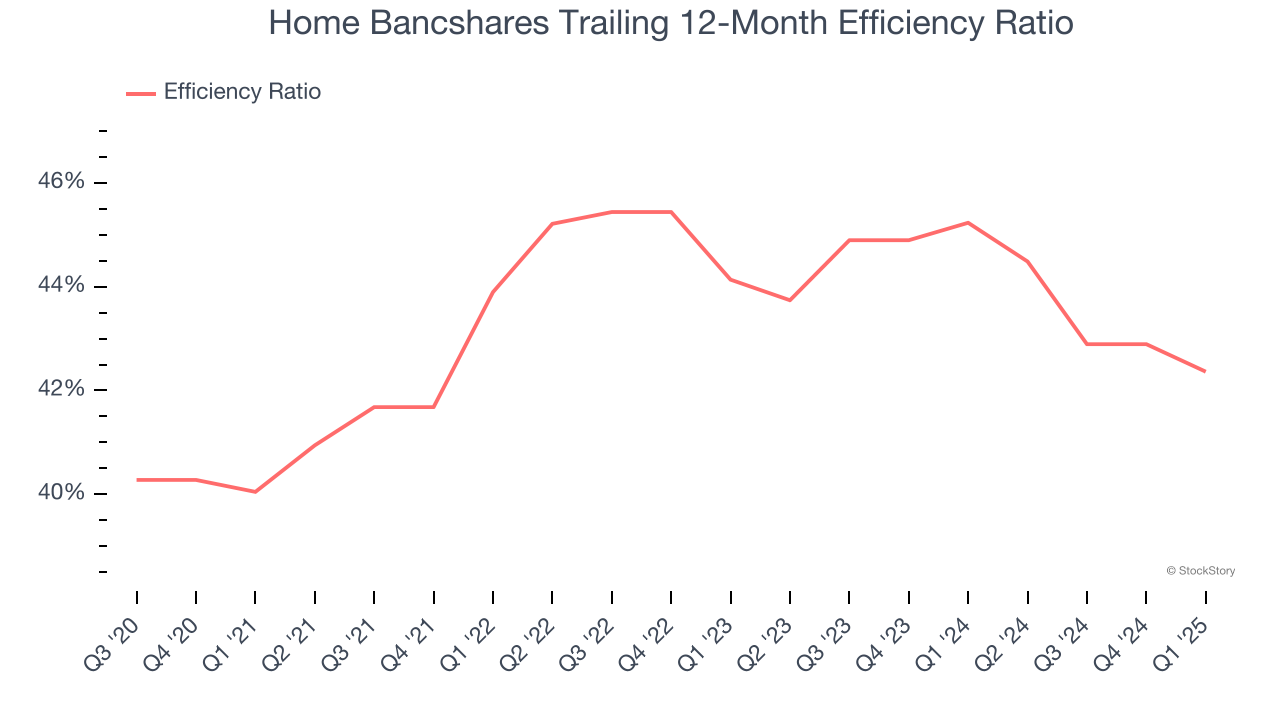

3. Efficiency Ratio Expected to Falter

Topline growth is certainly important, but the overall profitability of this growth matters for the bottom line. For banks, we look at efficiency ratio, which is non-interest expense (salaries, rent, IT, marketing, excluding interest paid out to depositors) as a percentage of total revenue.

Markets understand that a bank’s expense base depends on its revenue mix and what mostly drives share price performance is the change in this ratio, rather than its absolute value. It’s somewhat counterintuitive, but a lower efficiency ratio is better.

For the next 12 months, Wall Street expects Home Bancshares to become less profitable as it anticipates an efficiency ratio of 44% compared to 42.4% over the past year.

Final Judgment

Home Bancshares isn’t a terrible business, but it doesn’t pass our quality test. That said, the stock currently trades at 1.3× forward P/B (or $27.63 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think other companies feature superior fundamentals at the moment. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Would Buy Instead of Home Bancshares

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.