Over the past six months, Lindblad Expeditions’s stock price fell to $11.14. Shareholders have lost 8.7% of their capital, disappointing when considering the S&P 500 was flat. This might have investors contemplating their next move.

Is now the time to buy Lindblad Expeditions, or should you be careful about including it in your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Lindblad Expeditions Will Underperform?

Despite the more favorable entry price, we're swiping left on Lindblad Expeditions for now. Here are three reasons why you should be careful with LIND and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

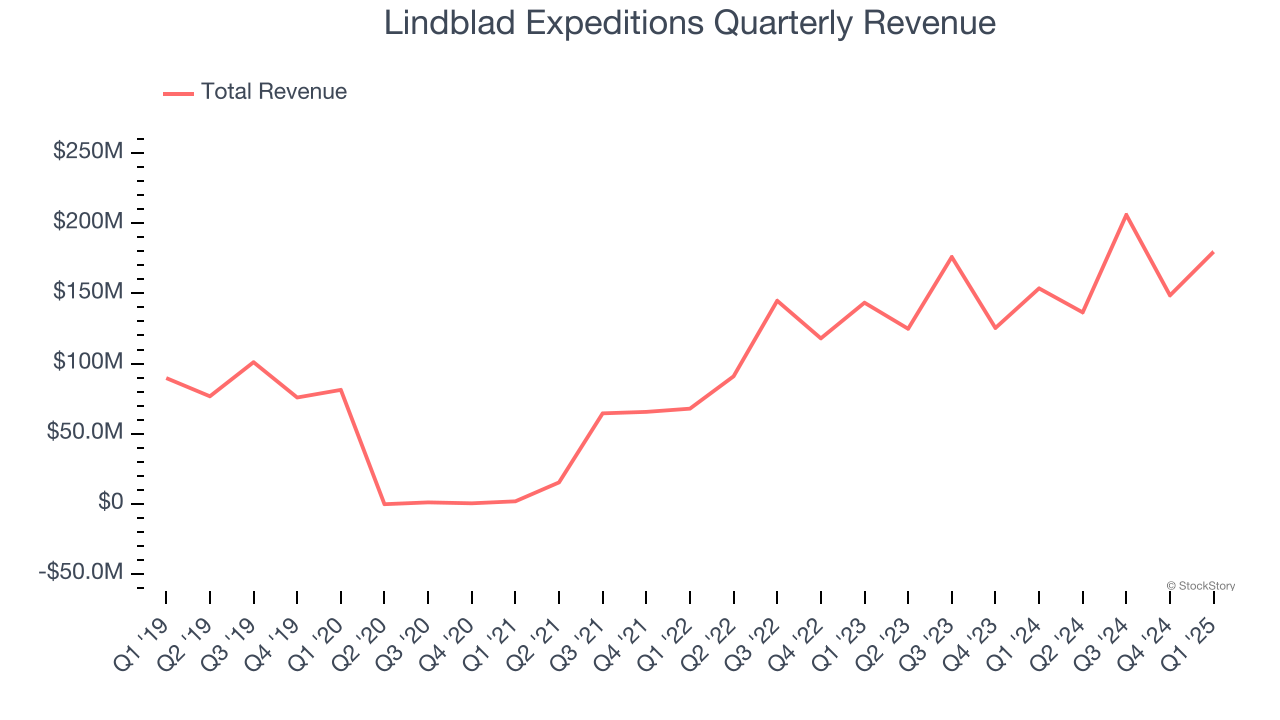

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Lindblad Expeditions grew its sales at a 14.9% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

2. EPS Trending Down

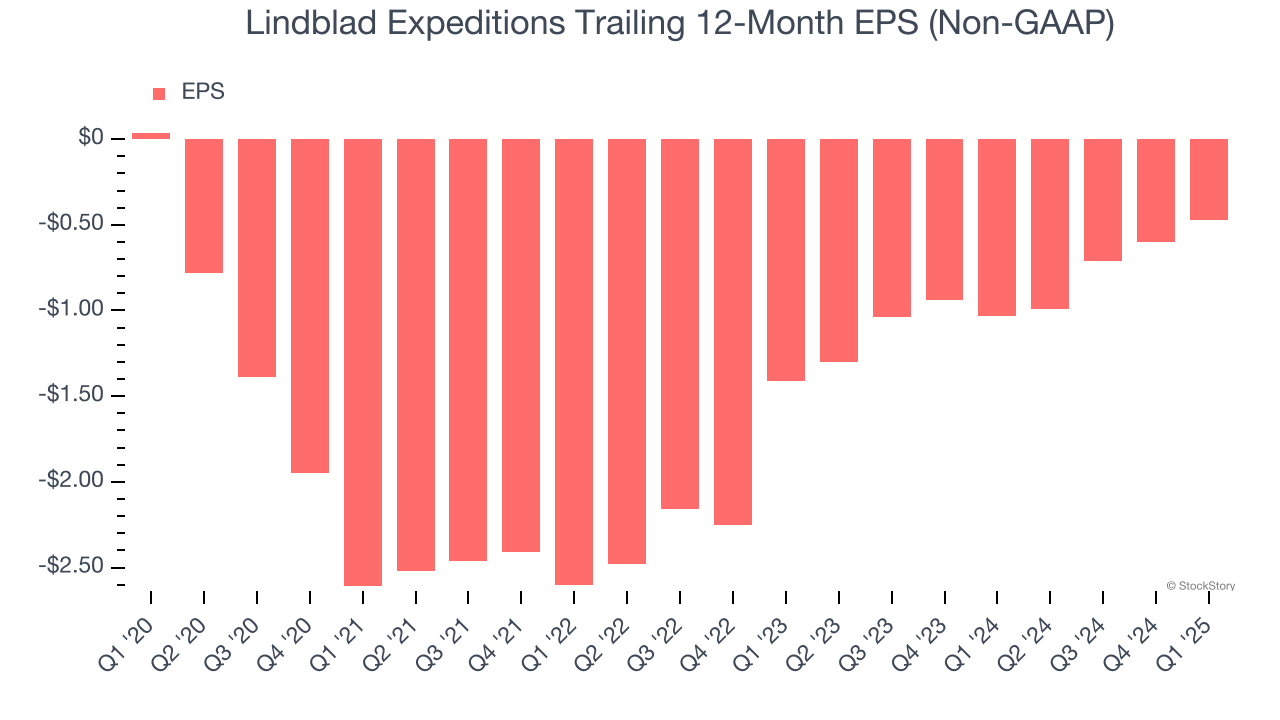

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Lindblad Expeditions, its EPS declined by 70.6% annually over the last five years while its revenue grew by 14.9%. This tells us the company became less profitable on a per-share basis as it expanded.

3. Previous Growth Initiatives Have Lost Money

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? Enter ROIC, a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

Lindblad Expeditions’s five-year average ROIC was negative 12.8%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

Final Judgment

We cheer for all companies serving everyday consumers, but in the case of Lindblad Expeditions, we’ll be cheering from the sidelines. Following the recent decline, the stock trades at 5.4× forward EV-to-EBITDA (or $11.14 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward the most entrenched endpoint security platform on the market.

High-Quality Stocks for All Market Conditions

The market surged in 2024 and reached record highs after Donald Trump’s presidential victory in November, but questions about new economic policies are adding much uncertainty for 2025.

While the crowd speculates what might happen next, we’re homing in on the companies that can succeed regardless of the political or macroeconomic environment. Put yourself in the driver’s seat and build a durable portfolio by checking out our Top 9 Market-Beating Stocks. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.