As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the finance and HR software industry, including Flywire (NASDAQ:FLYW) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 13 finance and HR software stocks we track reported a satisfactory Q1. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 1.2% below.

In light of this news, share prices of the companies have held steady as they are up 1.4% on average since the latest earnings results.

Best Q1: Flywire (NASDAQ:FLYW)

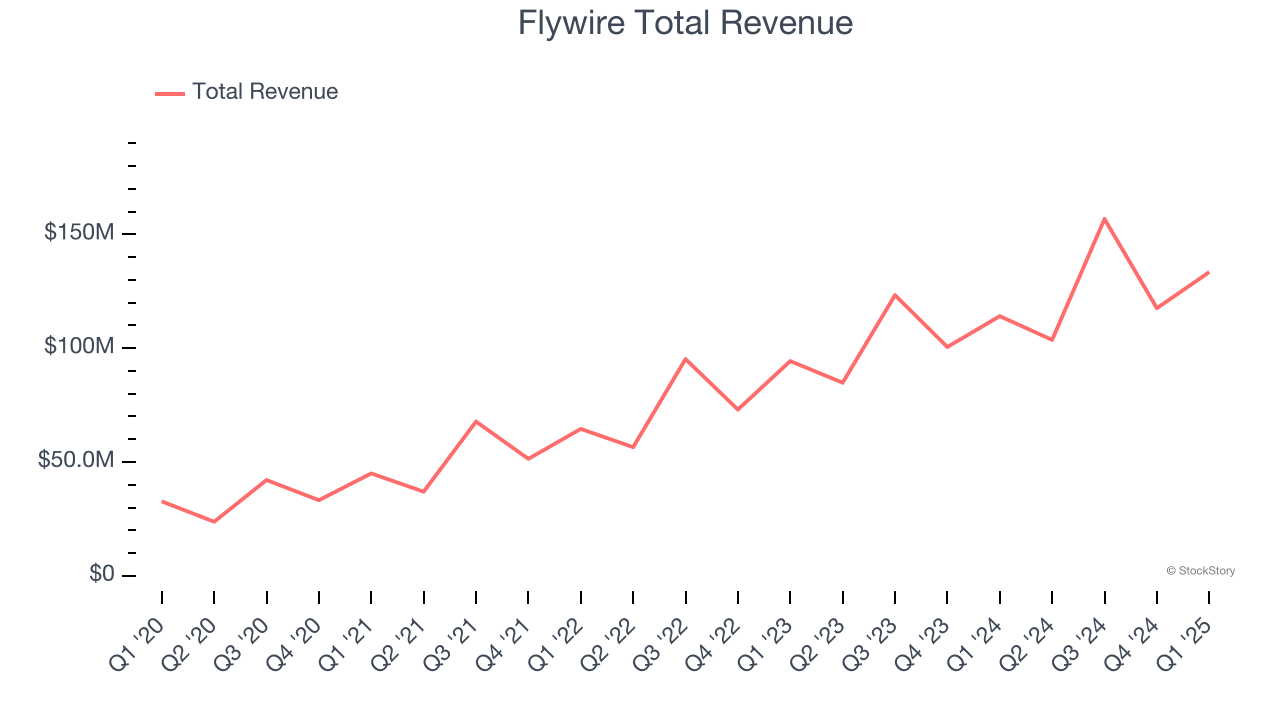

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $133.5 million, up 17% year on year. This print exceeded analysts’ expectations by 5%. Overall, it was a very strong quarter for the company with a solid beat of analysts’ EBITDA estimates and revenue guidance for next quarter meeting analysts’ expectations.

"We are pleased with our 2025 first quarter results, as we signed more than 200 new clients, led by our Travel and Education verticals, and exceeded the high end of our FX Neutral Revenue Guidance, while expanding Adjusted EBITDA margins above our guidance mid-point," said Mike Massaro, CEO of Flywire.

Flywire achieved the biggest analyst estimates beat of the whole group. The stock is up 8% since reporting and currently trades at $10.85.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it’s free.

Paylocity (NASDAQ:PCTY)

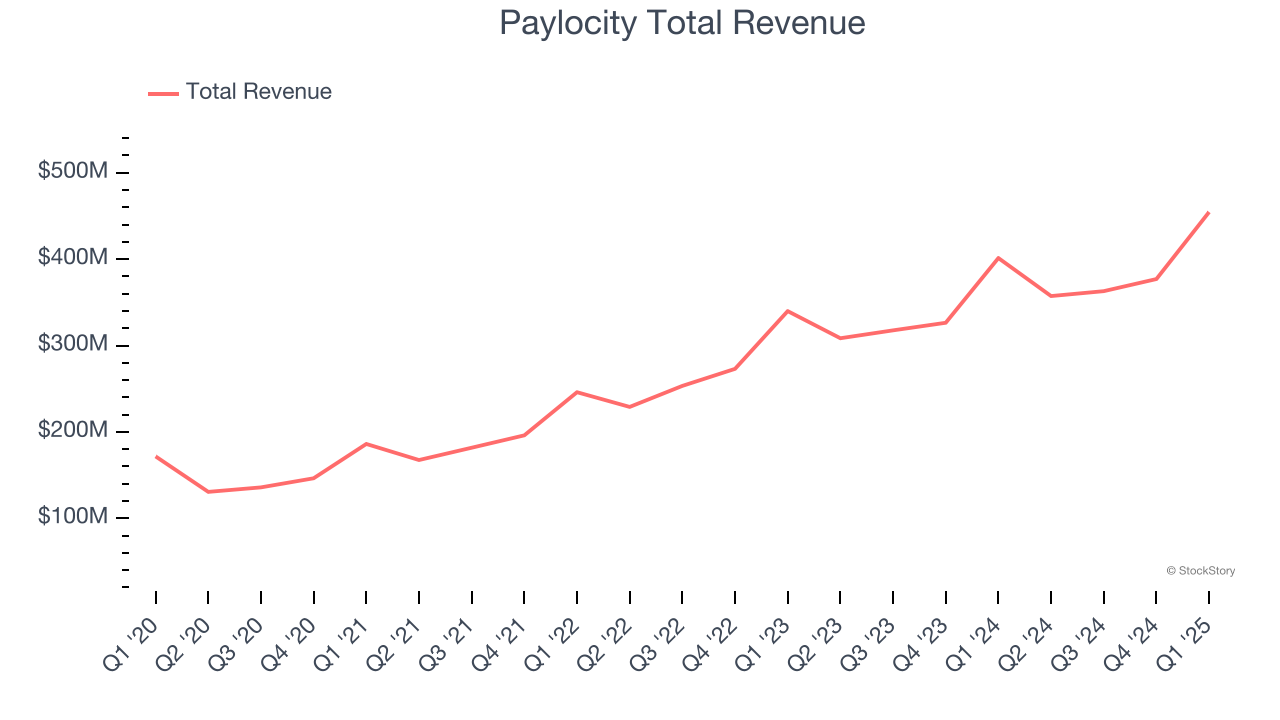

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and HR software for small and medium-sized enterprises.

Paylocity reported revenues of $454.5 million, up 13.3% year on year, outperforming analysts’ expectations by 2.9%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EBITDA guidance exceeding analysts’ expectations.

Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 9% since reporting. It currently trades at $176.78.

Is now the time to buy Paylocity? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Global Business Travel (NYSE:GBTG)

Holding close ties to American Express, Global Business Travel (NYSE:GBTG) is a comprehensive travel and expense management services provider to corporations worldwide.

Global Business Travel reported revenues of $621 million, up 1.8% year on year, falling short of analysts’ expectations by 1.9%. It was a disappointing quarter as it posted full-year EBITDA guidance missing analysts’ expectations.

Global Business Travel delivered the weakest performance against analyst estimates and slowest revenue growth in the group. As expected, the stock is down 12.3% since the results and currently trades at $6.04.

Read our full analysis of Global Business Travel’s results here.

Asure (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure reported revenues of $34.85 million, up 10.1% year on year. This number topped analysts’ expectations by 1.7%. More broadly, it was a satisfactory quarter as it also logged an impressive beat of analysts’ EBITDA estimates.

The stock is down 4.8% since reporting and currently trades at $9.30.

Read our full, actionable report on Asure here, it’s free.

Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $7.75 billion, up 15.1% year on year. This result surpassed analysts’ expectations by 2.6%. It was a very strong quarter as it also recorded full-year EPS guidance exceeding analysts’ expectations and an impressive beat of analysts’ EBITDA estimates.

Intuit achieved the highest full-year guidance raise among its peers. The stock is up 14.6% since reporting and currently trades at $762.99.

Read our full, actionable report on Intuit here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.