Wrapping up Q1 earnings, we look at the numbers and key takeaways for the productivity software stocks, including Atlassian (NASDAQ:TEAM) and its peers.

Rising employee costs and the shift to more remote work has increased the ever-present pressure to improve corporate productivity, which in turn has driven rising demand for productivity software that enables remote work, streamline project management and automate business tasks.

The 17 productivity software stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 3% while next quarter’s revenue guidance was in line.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

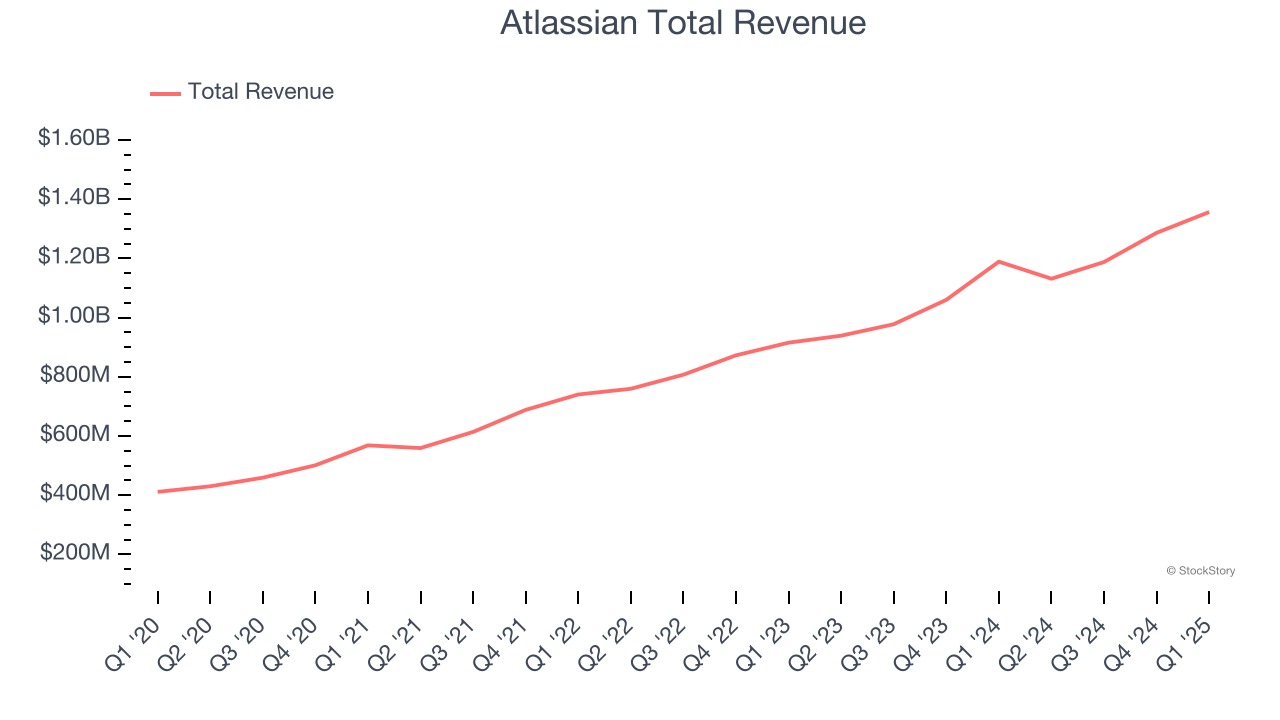

Atlassian (NASDAQ:TEAM)

Founded by Australian co-CEOs Mike Cannon-Brookes and Scott Farquhar in 2002, Atlassian (NASDAQ:TEAM) provides software as a service that makes it easier for large teams of software developers to manage projects, especially in software development.

Atlassian reported revenues of $1.36 billion, up 14.1% year on year. This print was in line with analysts’ expectations, but overall, it was a mixed quarter for the company with a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

“I am filled with immense pride as I reflect on Team ’25 and our customers’ and partners’ reactions to our relentless focus on innovation,” said Mike Cannon-Brookes, Atlassian’s CEO and co-Founder.

The stock is down 17% since reporting and currently trades at $190.

Is now the time to buy Atlassian? Access our full analysis of the earnings results here, it’s free.

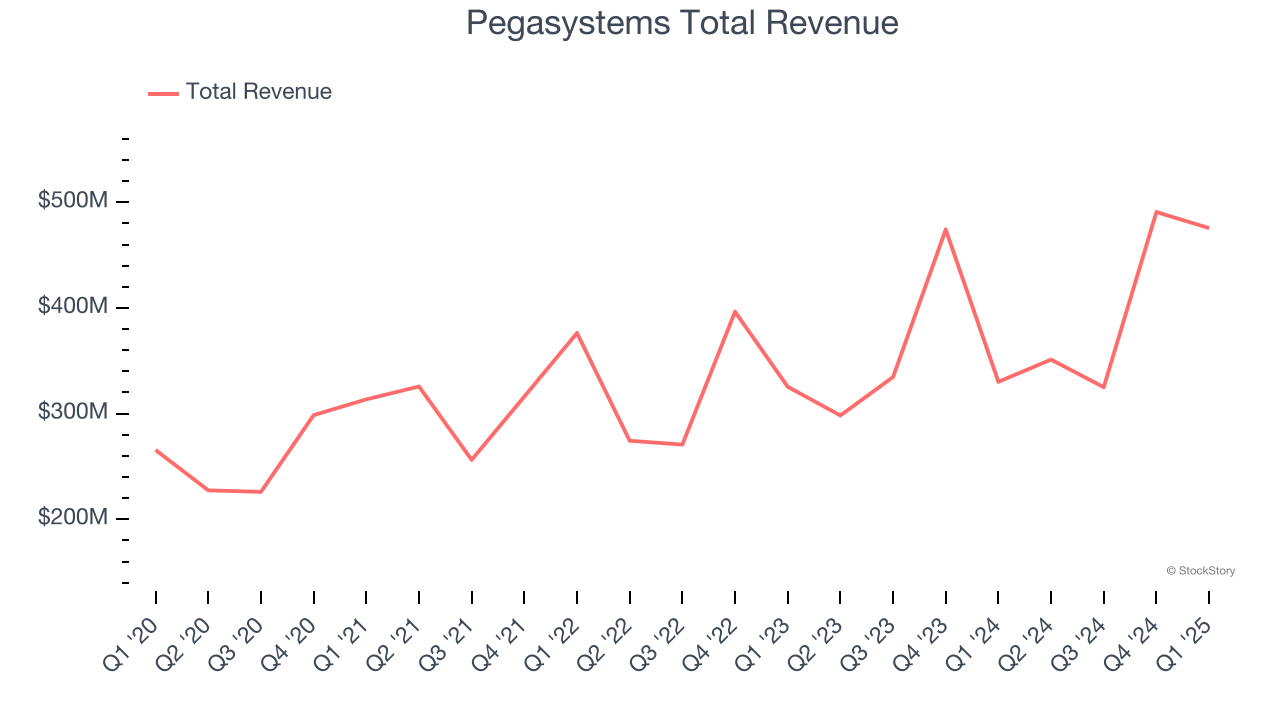

Best Q1: Pegasystems (NASDAQ:PEGA)

Founded by Alan Trefler in 1983, Pegasystems (NASDAQ:PEGA) offers a software-as-a-service platform to automate and optimize workflows in customer service and engagement.

Pegasystems reported revenues of $475.6 million, up 44.1% year on year, outperforming analysts’ expectations by 33.1%. The business had an incredible quarter with a solid beat of analysts’ billings estimates and an impressive beat of analysts’ EBITDA estimates.

Pegasystems scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 44.2% since reporting. It currently trades at $99.20.

Is now the time to buy Pegasystems? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: SoundHound AI (NASDAQ:SOUN)

Founded in 2005, SoundHound AI (NASDAQ:SOUN) develops independent voice artificial intelligence solutions that enable businesses across various industries to offer customized conversational experiences to consumers.

SoundHound AI reported revenues of $29.13 million, up 151% year on year, falling short of analysts’ expectations by 4.4%. It was a softer quarter as it posted a significant miss of analysts’ EBITDA estimates.

SoundHound AI delivered the fastest revenue growth but had the weakest performance against analyst estimates in the group. As expected, the stock is down 2.1% since the results and currently trades at $9.53.

Read our full analysis of SoundHound AI’s results here.

8x8 (NASDAQ:EGHT)

Founded in 1987, 8x8 (NYSE:EGHT) provides software for organizations to efficiently communicate and collaborate with their customers, employees, and partners.

8x8 reported revenues of $177 million, down 1.3% year on year. This print met analysts’ expectations. More broadly, it was a slower quarter as it produced a slight miss of analysts’ EBITDA estimates and billings in line with analysts’ estimates.

8x8 had the slowest revenue growth and weakest full-year guidance update among its peers. The stock is down 1.7% since reporting and currently trades at $1.76.

Read our full, actionable report on 8x8 here, it’s free.

Five9 (NASDAQ:FIVN)

Started in 2001, Five9 (NASDAQ: FIVN) offers software-as-a-service that makes it easier for companies to set up and efficiently run call centers to offer more tailored customer support.

Five9 reported revenues of $279.7 million, up 13.2% year on year. This number beat analysts’ expectations by 2.6%. Overall, it was a very strong quarter as it also produced EPS guidance for next quarter exceeding analysts’ expectations.

The stock is up 7.8% since reporting and currently trades at $27.05.

Read our full, actionable report on Five9 here, it’s free.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Top 6 Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.