Broadcom Inc. - Common Stock (AVGO)

333.24

+0.45 (0.14%)

NASDAQ · Last Trade: Jan 29th, 12:36 AM EST

Detailed Quote

| Previous Close | 332.79 |

|---|---|

| Open | 338.85 |

| Bid | 331.50 |

| Ask | 332.14 |

| Day's Range | 326.70 - 339.99 |

| 52 Week Range | 138.10 - 414.61 |

| Volume | 23,002,068 |

| Market Cap | 154.96B |

| PE Ratio (TTM) | 69.86 |

| EPS (TTM) | 4.8 |

| Dividend & Yield | 2.600 (0.78%) |

| 1 Month Average Volume | 24,740,969 |

Chart

About Broadcom Inc. - Common Stock (AVGO)

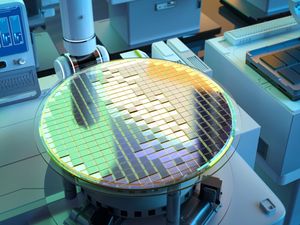

Broadcom Ltd is a global technology company that designs, develops, and supplies a wide range of semiconductor and infrastructure software solutions. The company specializes in producing chips that facilitate communication and data processing across various devices and networks, including those used in smartphones, enterprise storage systems, broadband access, and data centers. Additionally, Broadcom offers software solutions that enable businesses to optimize their operations, manage network security, and enhance performance across cloud-based and on-premises environments. Through its comprehensive portfolio, Broadcom plays a critical role in advancing connectivity and computing technologies in various industries. Read More

News & Press Releases

Intel stock has been surging of late, but the business is still well behind this manufacturing leader.

Via The Motley Fool · January 28, 2026

Broadcom is an easy way to profit from the secular expansion of the AI market.

Via The Motley Fool · January 28, 2026

The chipmaker remains a top play in the booming AI infrastructure market.

Via The Motley Fool · January 28, 2026

The first month of 2026 has witnessed an unprecedented transformation in the global credit markets. In a historic rush to secure capital for the burgeoning "AI arms race," U.S. corporate bond issuance has shattered previous records, reaching a staggering $95 billion in the first full week of January alone.

Via MarketMinute · January 28, 2026

The global technology landscape is undergoing a tectonic shift as the world’s largest "hyperscalers" abandon their traditional reliance on cash reserves to embrace a historic wave of debt financing. As of late January 2026, industry giants like Amazon.com Inc. (NASDAQ: AMZN) and Alphabet Inc. (NASDAQ: GOOGL) are leading

Via MarketMinute · January 28, 2026

This ETF targets investment-grade U.S. corporate bonds maturing in 2031, offering a defined maturity and predictable cash flow.

Via The Motley Fool · January 28, 2026

As the sun rises on the final days of January 2026, the financial world has its eyes fixed on a single entity: Meta Platforms (NASDAQ: META). Following a turbulent 2025 that saw the social media giant grapple with a "death cross" and fluctuating investor sentiment, the company is set to

Via MarketMinute · January 28, 2026

This ETF tracks investment grade corporate bonds maturing in 2030, providing defined maturity exposure for fixed income portfolios.

Via The Motley Fool · January 28, 2026

The Invesco BulletShares 2029 Corporate Bond ETF focuses on investment grade bonds with a fixed maturity, aiming for steady income streams.

Via The Motley Fool · January 28, 2026

In a move that has fundamentally rewritten the economics of the silicon age, OpenAI, SoftBank Group Corp. (TYO: 9984), and Oracle Corp. (NYSE: ORCL) have solidified their alliance under "Project Stargate"—a breathtaking $500 billion infrastructure initiative designed to build the world’s first 10-gigawatt "AI factory." As of late January 2026, the venture has transitioned from [...]

Via TokenRing AI · January 28, 2026

The transition from moving data via electricity to moving it via light—Silicon Photonics—has officially moved from the laboratory to the backbone of the world's largest AI clusters. By integrating optical engines directly into the processor package through Co-Packaged Optics (CPO), the industry is achieving a staggering 50% reduction in total networking energy consumption, effectively dismantling [...]

Via TokenRing AI · January 28, 2026

This AI chipmaker -- not Nvidia -- has been one of the best performers during this AI boom.

Via The Motley Fool · January 28, 2026

As of early 2026, the semiconductor landscape has reached a historic turning point, moving definitively away from the monolithic chip designs that defined the last fifty years. In their place, a new architecture known as 3.5D Advanced Packaging has emerged, powered by the Universal Chiplet Interconnect Express (UCIe) 3.0 standard. This development is not merely [...]

Via TokenRing AI · January 28, 2026

Micron may be one of the most undervalued AI stocks right now.

Via The Motley Fool · January 28, 2026

Dividend stocks are finally making a comeback in 2026, but not all dividend ETFs should be viewed the same.

Via The Motley Fool · January 28, 2026

Today’s Date: January 28, 2026 Introduction In the high-stakes arms race of Artificial Intelligence (AI) infrastructure, the spotlight often falls on the "brains" of the operation—the high-performance GPUs and TPUs produced by the likes of Nvidia and AMD. However, as AI clusters scale from thousands to hundreds of thousands of interconnected processors, a new bottleneck [...]

Via Finterra · January 28, 2026

Broadcom is an AI stock with significant upside potential for shareholders, thanks to its leadership in the ASIC design segment.

Via Barchart.com · January 28, 2026

AVGO and MRVL are both expected to benefit.

Via Barchart.com · January 28, 2026

As the global race for Artificial General Intelligence (AGI) accelerates, the infrastructure supporting these massive models has hit a physical "Copper Wall." Traditional electrical interconnects, which have long served as the nervous system of the data center, are struggling to keep pace with the staggering bandwidth requirements and power consumption of next-generation AI clusters. In [...]

Via TokenRing AI · January 28, 2026

As of January 28, 2026, the global race for artificial intelligence dominance is no longer being fought solely in the realm of algorithmic breakthroughs or raw transistor counts. Instead, the front line of the AI revolution has moved to a high-precision manufacturing stage known as "Advanced Packaging." At the heart of this struggle is Taiwan [...]

Via TokenRing AI · January 28, 2026

The semiconductor industry has officially entered a new epoch. As of January 2026, the long-predicted "Glass Age" of chip packaging is no longer a roadmap item—it is a production reality. Intel Corporation (NASDAQ:INTC) has successfully transitioned its glass substrate technology from the laboratory to high-volume manufacturing, marking the most significant shift in chip architecture since [...]

Via TokenRing AI · January 28, 2026

Semiconductor stocks look poised for further gains as investment in artificial intelligence (AI) infrastructure accelerates.

Via The Motley Fool · January 28, 2026

As of January 27, 2026, the financial world is witnessing a historic realignment that few saw coming eighteen months ago: silver has officially decoupled from its reputation as a "poor man's gold" to become the most sought-after industrial commodity of the artificial intelligence era. Last week, on January 23, the

Via MarketMinute · January 27, 2026

As the closing bell approaches on January 27, 2026, the global financial community has fixed its gaze on Redmond. Tomorrow, Microsoft (NASDAQ: MSFT) is scheduled to release its fiscal second-quarter 2026 earnings report, an event that has become the definitive pulse check for the artificial intelligence revolution. With the company’

Via MarketMinute · January 27, 2026

As of January 27, 2026, the artificial intelligence industry has officially hit the "Photonic Pivot." For years, the bottleneck of AI progress wasn't just the speed of the processor, but the speed at which data could move between them. Today, that bottleneck is being dismantled. Silicon Photonics, or Photonic Integrated Circuits (PICs), have moved from [...]

Via TokenRing AI · January 27, 2026