NVIDIA Corp (NVDA)

191.52

+0.00 (0.00%)

NASDAQ · Last Trade: Jan 29th, 5:50 AM EST

Detailed Quote

| Previous Close | 191.52 |

|---|---|

| Open | - |

| Bid | 190.58 |

| Ask | 190.63 |

| Day's Range | N/A - N/A |

| 52 Week Range | 86.62 - 212.19 |

| Volume | 286,964 |

| Market Cap | 4.65T |

| PE Ratio (TTM) | 47.41 |

| EPS (TTM) | 4.0 |

| Dividend & Yield | 0.0400 (0.02%) |

| 1 Month Average Volume | 156,189,978 |

Chart

About NVIDIA Corp (NVDA)

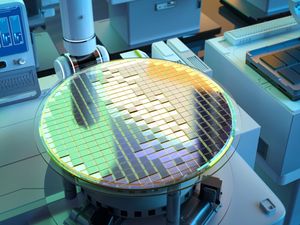

NVIDIA Corporation is a leading technology company primarily known for its innovations in graphics processing units (GPUs) that enhance visual computing across various applications, including gaming, professional visualization, and artificial intelligence. Beyond its strong presence in gaming, NVIDIA's products are integral to deep learning and data center solutions, empowering advancements in machine learning, autonomous vehicles, and high-performance computing. By leveraging its cutting-edge technologies, NVIDIA aims to drive the future of computing and improve experiences across industries, from entertainment to scientific research. Read More

News & Press Releases

Artificial intelligence (AI) software upgrades and the highly anticipated launch of the iPhone 18 are top of mind for Apple investors in 2026.

Via The Motley Fool · January 29, 2026

Meta Platforms will significantly increase capital expenditures in 2026.

Via The Motley Fool · January 29, 2026

Former hedge fund manager Jim Cramer says shares of Amazon and Uber can go even higher.

Via The Motley Fool · January 29, 2026

NVIDIA CORP (NASDAQ:NVDA) Combines High-Growth Momentum with Bullish Technical Setupchartmill.com

Via Chartmill · January 29, 2026

You're working hard for your extra money. Now make your extra money work hard for you.

Via The Motley Fool · January 29, 2026

Viking Global Investors' billionaire boss sent shares of two trillion-dollar club members to the chopping block and made another of the stock market's largest companies a top-five holding.

Via The Motley Fool · January 29, 2026

Retail sentiment on major ETFs such as SPY and QQQ remains ‘extremely bearish’ on Stocktwits.

Via Stocktwits · January 29, 2026

OpenAI is reportedly in discussions to secure funding of nearly $40 billion from its major suppliers, NVIDIA, Amazon, and Microsoft.

Via Benzinga · January 29, 2026

CoreWeave has built a compelling AI cloud product despite the stiff competition in the space.

Via The Motley Fool · January 29, 2026

AI infrastructure stocks like Arista and CoreWeave are surging. Backed by a $2.1B Nvidia investment, CoreWeave has spiked 40% this month, while Arista rides the 800G networking wave for hyperscalers like Meta.

Via Talk Markets · January 29, 2026

Is China about to allow its tech companies to purchase Nvidia AI chips?

Via The Motley Fool · January 29, 2026

The Fed Hits Pause — and the AI Spending Arms Race Hits the Gaschartmill.com

Via Chartmill · January 29, 2026

Recent reports also note that SoftBank is eyeing a further $30 billion investment.

Via Stocktwits · January 29, 2026

The Technology Select Sector SPDR Fund spreads exposure across tech, while the Roundhill Generative AI and Technology ETF concentrates it around AI. This ETF comparison shows why that difference matters when AI valuations come under pressure.

Via The Motley Fool · January 29, 2026

Intel stock has been surging of late, but the business is still well behind this manufacturing leader.

Via The Motley Fool · January 28, 2026

Lam Research joined ASML in posting upbeat financial numbers.

Via Stocktwits · January 28, 2026

U.S. lawmaker Rep. John Moolenaar alleges that Nvidia provided technical assistance to China's DeepSeek, helping it train advanced AI models more efficiently, which are now believed to have been used by China's military, sparking bipartisan concern over U.S. chip exports.

Via Benzinga · January 28, 2026

Broadcom is an easy way to profit from the secular expansion of the AI market.

Via The Motley Fool · January 28, 2026

The chipmaker remains a top play in the booming AI infrastructure market.

Via The Motley Fool · January 28, 2026

NEW YORK — As the calendar turns to late January 2026, the U.S. equity markets are not merely climbing; they are accelerating. With the S&P 500 eyeing a historic 7,500 level, the narrative on Wall Street has shifted from "soft landing" to a "policy-driven rocket ship." This surge

Via MarketMinute · January 28, 2026

Investment banking firm Houlihan Lokey (NYSE:HLI) beat Wall Street’s revenue expectations in Q4 CY2025, with sales up 13% year on year to $717.1 million. Its non-GAAP profit of $1.94 per share was 3.6% above analysts’ consensus estimates.

Via StockStory · January 28, 2026

As of late January 2026, a seismic shift is rattling the foundations of Wall Street. After a multi-year era defined by the undisputed dominance of a handful of tech titans, the long-prophesied "Great Rotation" has finally arrived. The Russell 2000, the bellwether index for small-cap stocks, has surged nearly 8%

Via MarketMinute · January 28, 2026

As of January 28, 2026, the U.S. financial markets are basking in a rare "risk-on" atmosphere, driven by a simultaneous easing of major international conflicts that have haunted global trade for years. With the S&P 500 (INDEXSP:.INX) breaching the 7,200 level for the first time, investors

Via MarketMinute · January 28, 2026

The first month of 2026 has witnessed an unprecedented transformation in the global credit markets. In a historic rush to secure capital for the burgeoning "AI arms race," U.S. corporate bond issuance has shattered previous records, reaching a staggering $95 billion in the first full week of January alone.

Via MarketMinute · January 28, 2026

On January 28, 2026, the S&P 500 reached a momentous milestone, crossing the 7,000-point threshold for the first time in history. While the headline figure suggests a broad-based economic triumph, the underlying mechanics reveal a market more concentrated than ever before. The Information Technology sector now accounts for

Via MarketMinute · January 28, 2026