Palo Alto Networks, Inc. - Common Stock (PANW)

186.88

+1.00 (0.54%)

NASDAQ · Last Trade: Dec 20th, 1:21 PM EST

PANW Stock Rises As Company Teams Up To Secure AI Workloads Against Threatsstocktwits.com

Via Stocktwits · December 19, 2025

Before the US market kicks off on Friday, let's examine the pre-market session and unveil the notable performers among the S&P500 top gainers and losers.

Via Chartmill · December 19, 2025

The best-performing stocks typically have robust sales growth, increasing margins, and rising returns on capital,

and those that can maintain this trifecta year in and year out often become the legends of the investing world.

Via StockStory · December 18, 2025

Via Benzinga · December 18, 2025

As 2025 draws to a close, the artificial intelligence investment landscape has undergone a profound transformation. The "generative hype" of previous years has matured into a disciplined focus on the infrastructure of trust and the physical manifestation of intelligence. This shift is most visible in the surge of specialized Exchange-Traded Funds (ETFs) targeting AI Security [...]

Via TokenRing AI · December 18, 2025

Most investors focus on direction in PANW stock. This analysis shows how probability concentration can guide smarter, risk-defined strategies.

Via Barchart.com · December 18, 2025

Over the past year, CrowdStrike has outpaced its industry peers, and analysts remain moderately optimistic about the stock’s prospects.

Via Barchart.com · December 18, 2025

On December 17, 2025, the Nasdaq Composite Index experienced a significant downturn, shedding 350 points, or 1.5%, and falling below several critical support levels. This latest slump marks a concerning divergence in the broader market, as the tech-heavy index struggles while the Dow Jones Industrial Average concurrently reaches new

Via MarketMinute · December 17, 2025

The technology sector is currently navigating a turbulent period, marked by a significant and deepening selloff that is exerting immense pressure on the Nasdaq Composite. As of December 17, 2025, a confluence of escalating "AI bubble" fears, disappointing corporate earnings, a noticeable rotation of capital away from speculative growth stocks,

Via MarketMinute · December 17, 2025

In a landmark move poised to redefine the landscape of cybersecurity, CrowdStrike Holdings, Inc. (NASDAQ: CRWD) announced the general availability of Falcon AI Detection and Response (AIDR) on December 15, 2025. This groundbreaking offering extends the capabilities of the renowned CrowdStrike Falcon platform to secure the rapidly expanding and critically vulnerable AI prompt and agent [...]

Via TokenRing AI · December 16, 2025

Despite recent pockets of volatility and "slips" in the U.S. stock market during late 2025, a robust corporate profit outlook is emerging as a powerful counter-narrative, fueling investor optimism and suggesting that still-higher prices for American equities may be on the horizon. While the Cboe Volatility Index (VIX) saw

Via MarketMinute · December 16, 2025

December 16, 2025 – The "buying the dip" investment strategy, which involves purchasing an asset after its price has declined with the anticipation of a subsequent recovery, has seen significant relevance and success in financial markets throughout 2025. This approach leverages temporary market downturns as opportunities to acquire assets at a

Via MarketMinute · December 16, 2025

Shares of telecommunications infrastructure company Lumen Technologies (NYSE:LUMN) fell 4.2% in the afternoon session after a broad sell-off in the technology sector and continued concerns about the company's financial health.

Via StockStory · December 15, 2025

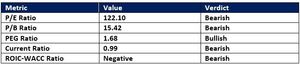

Excessive valuations, high capital expenditures, and a dismal average return on invested capital raise red flags.

Via Talk Markets · December 15, 2025

While strong cash flow is a key indicator of stability, it doesn’t always translate to superior returns.

Some cash-heavy businesses struggle with inefficient spending, slowing demand, or weak competitive positioning.

Via StockStory · December 14, 2025

The artificial intelligence landscape, as of late 2025, is undergoing a profound transformation, shifting from an era of speculative enthusiasm to a demand for tangible returns and robust business models. While NVIDIA (NASDAQ: NVDA) has undeniably dominated the initial phase of the AI revolution with its powerful GPUs, the market

Via MarketMinute · December 12, 2025

Netskope reported earnings for the first time, but the market was underwhelmed.

Via The Motley Fool · December 12, 2025

Prelude Capital Bets Heavily on CyberArk Software (CYBR) With a 29,406 Share Purchase

Via The Motley Fool · December 12, 2025

The foundational layer of modern technology, the semiconductor ecosystem, finds itself at the epicenter of an escalating cybersecurity crisis. This intricate global network, responsible for producing the chips that power everything from smartphones to critical infrastructure and advanced AI systems, is a prime target for sophisticated cybercriminals and state-sponsored actors. The integrity of its intellectual [...]

Via TokenRing AI · December 12, 2025

Growth is oxygen.

But when it evaporates, the consequences can be severe - ask anyone who bought Cisco in the Dot-Com Bubble or newer investors who lived through the 2020 to 2022 COVID cycle.

Via StockStory · December 11, 2025

As 2025 draws to a close, a powerful undercurrent of technological innovation, extending far beyond the pervasive influence of artificial intelligence, is demonstrably reshaping the global stock market. From the intricate defenses of cybersecurity to the vast frontiers of space technology, and from life-saving biotechnological breakthroughs to the efficiency gains

Via MarketMinute · December 11, 2025

As global markets navigate the complex currents of economic policy and technological innovation, an often-underestimated force—geopolitical instability—remains a potent catalyst for market shifts. While the precise nature of future events is inherently unpredictable, the potential for geopolitical developments to trigger significant short-term volatility and influence long-term market trajectories

Via MarketMinute · December 11, 2025

Greenvale Capital sold its entire stake of Cyberark Software during the third quarter of 2025.

Via The Motley Fool · December 11, 2025