Block, Inc. Class A Common Stock (SQ)

86.96

+0.00 (0.00%)

NYSE · Last Trade: Jan 29th, 5:55 AM EST

Detailed Quote

| Previous Close | 86.96 |

|---|---|

| Open | - |

| Bid | 86.96 |

| Ask | 87.19 |

| Day's Range | N/A - N/A |

| 52 Week Range | N/A - N/A |

| Volume | 0 |

| Market Cap | 45.44B |

| PE Ratio (TTM) | 17.50 |

| EPS (TTM) | 5.0 |

| Dividend & Yield | N/A (N/A) |

| 1 Month Average Volume | - |

Chart

About Block, Inc. Class A Common Stock (SQ)

Block Inc is a financial technology company that provides various services aimed at simplifying commerce and enhancing the financial experience for businesses and individuals. The company offers a suite of products, including payment processing solutions, point-of-sale software, and financial management tools, designed to empower sellers of all sizes. Additionally, Block Inc operates Cash App, a mobile payment service that enables users to send, receive, and invest money easily. By focusing on innovation and user-friendly technology, Block Inc aims to drive financial inclusion and streamline transactions for its diverse customer base. Read More

News & Press Releases

The artificial intelligence industry has reached a pivotal milestone with the widespread adoption of the Model Context Protocol (MCP), an open standard that has effectively solved the "interoperability crisis" that once hindered enterprise AI deployment. Originally introduced by Anthropic in late 2024, the protocol has evolved into the universal language for AI agents, allowing them [...]

Via TokenRing AI · January 28, 2026

As the final week of January 2026 unfolds, the financial world is bracing for a collision of data points that will likely define the market's trajectory for the first half of the year. While the "Magnificent 7" tech giants are preparing to unveil their multi-billion dollar AI investments, it is

Via MarketMinute · January 27, 2026

In a week that has shaken investor confidence in the resilience of the American spender, Capital One Financial (NYSE: COF) reported fourth-quarter 2025 earnings that sharply missed analyst expectations. While the banking giant posted a significant revenue beat—largely fueled by its completed integration of Discover Financial Services—the bottom

Via MarketMinute · January 26, 2026

The opening weeks of 2026 have ushered in a transformative wave of merger and acquisition (M&A) activity in the United States, signaling a definitive end to the deal-making drought that plagued the early 2020s. Following a robust 2025 that saw total deal values climb to a staggering $2.3

Via MarketMinute · January 26, 2026

In a quarter defined by the messy resolution of long-standing geopolitical entanglements, Citigroup (NYSE: C) reported a sharp 13.4% decline in fourth-quarter profits for 2025, driven primarily by a $1.2 billion accounting loss tied to its final departure from the Russian market. The results, released on January 14,

Via MarketMinute · January 20, 2026

As of January 2026, the artificial intelligence industry has reached a watershed moment. The "walled gardens" that once defined the early 2020s—where data stayed trapped in specific platforms and agents could only speak to a single provider’s model—have largely crumbled. This tectonic shift is driven by the Model Context Protocol (MCP), a standardized framework that [...]

Via TokenRing AI · January 19, 2026

NEW YORK — The third week of January 2026 has proven to be a sobering reality check for the U.S. financial sector. As of Monday, January 19, 2026, investors are still parsing a turbulent week that saw billions in market capitalization evaporated from the nation’s largest lenders. A volatile

Via MarketMinute · January 19, 2026

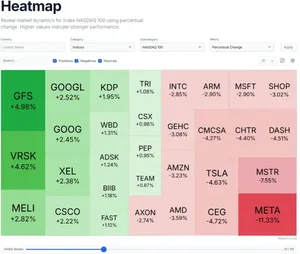

For investors, analyzing hundreds of stocks simultaneously is a daily challenge. We often rely on stock heatmaps to quickly get an overview of the S&P 500, Nasdaq 100, or the Dow 30. But most tools we use have a fundamental design problem: they don't adapt to what you actually want to see. The problem with [...]

Via Visibility · January 16, 2026

Today’s Date: January 16, 2026 Introduction As we enter 2026, PayPal Holdings, Inc. (NASDAQ: PYPL) finds itself at a critical juncture in the history of digital finance. Once the undisputed king of the online "checkout button," the company has spent the last two years under the aggressive leadership of CEO Alex Chriss, attempting to shed [...]

Via Finterra · January 16, 2026

As the financial world rings in 2026, the initial public offering (IPO) market is experiencing a transformative "mega-wave" that has analysts and retail investors alike bracing for a historic year. Following a steady recovery in 2025, the 2026 pipeline is now dominated by the much-anticipated debuts of generational technology leaders,

Via MarketMinute · January 15, 2026

The global payment landscape faced a seismic shift this week as shares of the world’s dominant credit networks underwent a severe technical breakdown. The catalyst was a bold legislative and executive push to impose a national 10% cap on credit card interest rates—a move that sent shockwaves through

Via MarketMinute · January 13, 2026

As of January 13, 2026, the financial technology landscape has moved far beyond the simple "buy button." For PayPal Holdings, Inc. (NASDAQ: PYPL), the journey from a pandemic-era darling to a value-stock turnaround story has been fraught with skepticism. However, a pivotal shift is underway. Under the leadership of CEO Alex Chriss, the company is [...]

Via PredictStreet · January 13, 2026

The financial landscape was sent into a tailspin on January 9, 2026, when President Donald Trump announced a sweeping proposal to implement a temporary, one-year 10% cap on all credit card interest rates, effective January 20. The announcement, delivered via social media and followed by a brief press conference, has

Via MarketMinute · January 12, 2026

NEW YORK — Shares of Synchrony Financial (NYSE: SYF) plummeted more than 8% on Monday as investors reacted with alarm to a weekend proposal from President-elect Donald Trump to institute a temporary 10% cap on credit card interest rates. The announcement, which sent shockwaves through the consumer finance sector, has ignited

Via MarketMinute · January 12, 2026

As of January 8, 2026, Angi Inc. (NASDAQ: ANGI) finds itself at a critical crossroads. Long the dominant name in the fragmented U.S. home services market, the company has spent the last decade navigating a complex merger, a multi-year brand consolidation, and most recently, a full spin-off from its former parent, IAC Inc. (NASDAQ: IAC). [...]

Via PredictStreet · January 8, 2026

The nutritional snacking landscape has entered a volatile era of transition, and perhaps no company better illustrates this shift than The Simply Good Foods Company (NASDAQ: SMPL). As of January 8, 2026, the company finds itself at a crossroads: managing the structural decline of its legacy Atkins brand while simultaneously scaling its high-growth engines, Quest [...]

Via PredictStreet · January 8, 2026

As of January 8, 2026, Acuity Brands (NYSE: AYI) stands at a pivotal crossroads in its century-long history. Long perceived as a legacy manufacturer of light fixtures and bulbs, the company has spent the last five years aggressively pivoting toward a future defined by the "Internet of Things" (IoT) and intelligent building management. Today’s release [...]

Via PredictStreet · January 8, 2026

In the high-stakes world of global IT distribution, few names carry as much weight—or as much hardware—as TD Synnex (NYSE: SNX). Standing as the world’s largest IT solutions aggregator, the company serves as the critical bridge between the world’s most advanced technology manufacturers and the millions of businesses that need their products. On January 8, [...]

Via PredictStreet · January 8, 2026

In the industrial heartland of American manufacturing, few companies have undergone a transformation as profound as Commercial Metals (NYSE: CMC). Once a traditional scrap metal recycler, CMC has emerged as a vertically integrated powerhouse at the intersection of steel production and infrastructure solutions. On January 8, 2026, the company cemented its status as a market [...]

Via PredictStreet · January 8, 2026

Date: January 8, 2026 Introduction As of early 2026, NVIDIA (NASDAQ: NVDA) stands as the undisputed titan of the global economy. Having surpassed a historic $5 trillion market capitalization in late 2025, the company has evolved from a niche semiconductor designer into the primary architect of the "Intelligence Age." In an era where computational power [...]

Via PredictStreet · January 8, 2026

As of January 8, 2026, Palo Alto Networks (NASDAQ: PANW) stands as the preeminent titan of the cybersecurity sector, a position solidified by its audacious and initially controversial "platformization" strategy launched nearly two years ago. While the broader technology market has grappled with the volatility of the AI-driven "Second Wave," Palo Alto Networks has emerged [...]

Via PredictStreet · January 8, 2026

As of January 8, 2026, the landscape of high-performance computing (HPC) has undergone a tectonic shift, and few companies embody this transformation more than Applied Digital (Nasdaq: APLD). Once a niche player in the cryptocurrency hosting space, Applied Digital has successfully repositioned itself as a critical backbone for the generative AI revolution. The company is [...]

Via PredictStreet · January 8, 2026

In a move that signals a seismic shift in the artificial intelligence landscape, Anthropic and the Linux Foundation have officially launched the Agentic AI Foundation (AAIF). Announced on December 9, 2025, this collaborative initiative marks a transition from the era of conversational chatbots to a future defined by autonomous, interoperable AI agents. By establishing a [...]

Via TokenRing AI · January 5, 2026

As of early 2026, the artificial intelligence landscape has shifted from a race for larger models to a race for more integrated, capable agents. At the center of this transformation is Anthropic’s Model Context Protocol (MCP), a revolutionary open standard that has earned the moniker "USB-C for AI." By creating a universal interface for AI [...]

Via TokenRing AI · January 5, 2026

As of December 24, 2025, the financial world is witnessing a historic convergence of traditional banking dominance and the inevitable shift toward digital assets. JPMorgan Chase & Co. (NYSE: JPM) has once again solidified its position as the titan of Wall Street, reaching a fresh all-time high of $327.78 just yesterday. However, the story isn't [...]

Via PredictStreet · December 24, 2025